Quick Answer

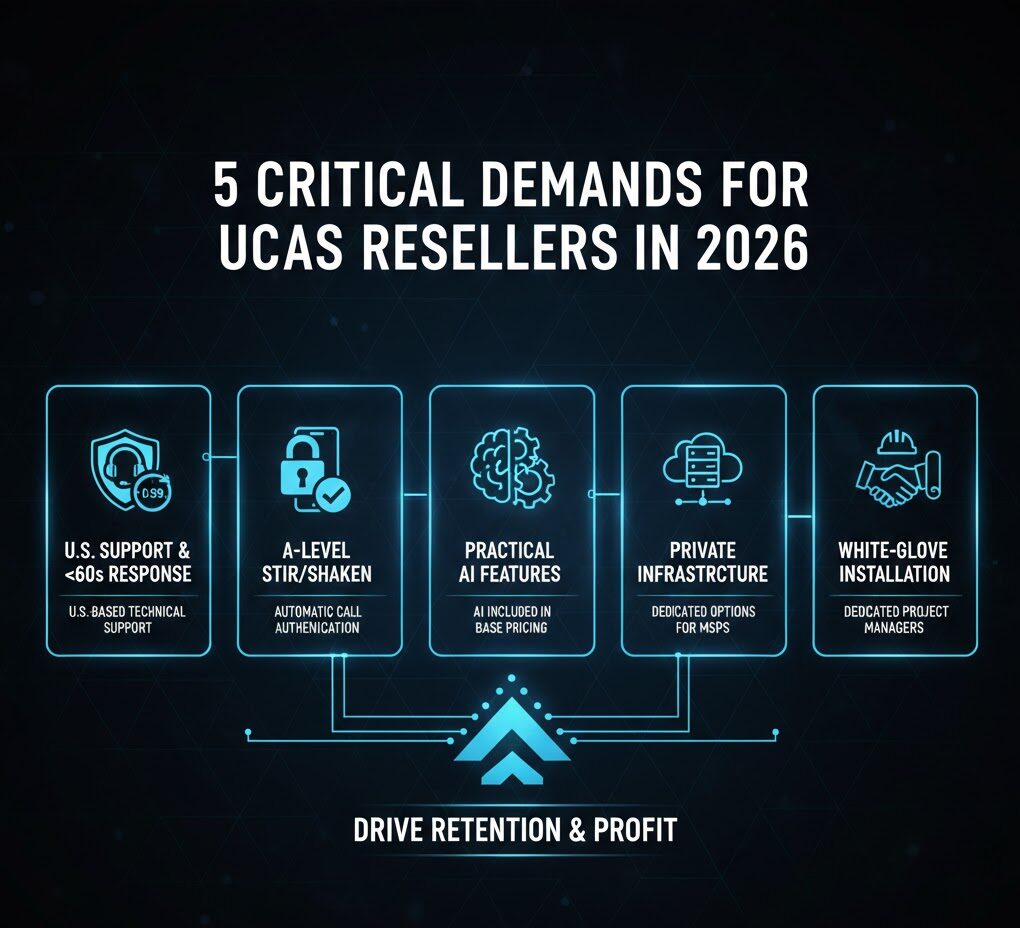

MSP UCaaS resellers should demand five critical elements from UCaaS resellers in 2026: (1) U.S.-based technical support with sub-60-second response times, (2) automatic A-level STIR/SHAKEN attestation management, (3) practical AI features included in base pricing, (4) private infrastructure options for mission-critical clients, and (5) white-glove installation with dedicated project managers. The shift from commodity reselling to strategic partnership requires resellers who protect MSP margins, solve problems proactively, and deliver client experiences that drive retention rather than churn.

AI Summary

MSP UCaaS resellers selecting UCaaS in 2026 face a market where vendor support quality has deteriorated dramatically, spam call labeling threatens client communications, and AI features often cost more than they deliver. Critical selection criteria include verifiable support responsiveness (not just “24/7 availability” claims), proactive STIR/SHAKEN attestation management that prevents client calls from being flagged as spam, and AI features with measurable ROI rather than expensive add-ons. The best UCaaS resellers provide U.S.-based technical support with actual technicians (not offshore ticket systems), handle call attestation complexities automatically, offer private infrastructure instead of shared multitenant platforms, and include practical AI tools like call summarization in base pricing rather than charging premium rates for features that should be standard. MSPs should evaluate resellers on post-sale support quality, compliance management capabilities, infrastructure reliability (99.999% uptime vs marketed claims), transparent pricing without hidden AI fees, and white-glove installation that eliminates implementation chaos. The shift from commodity UCaaS reselling to strategic partnership requires resellers who protect MSP margins, solve technical problems proactively, and deliver client experiences that drive retention rather than churn.

Choosing the right MSP UCaaS reseller in 2026 matters more than ever. The UCaaS reseller market has become a race to the bottom. Every vendor claims “enterprise-grade reliability” and “24/7 support” while delivering offshore ticket queues and shared infrastructure that crashes under load.

MSPs stuck in bad reseller relationships know the pattern. Client calls get flagged as “Spam Likely” with no warning. Support tickets disappear for days. “Included” AI features require premium upgrades. The reseller that promised partnership acts like a commodity vendor after contracts are signed.

In 2026, MSPs need to demand more—because the MSPs who tolerate mediocrity will lose clients to those who don’t.

The Support Crisis Nobody Talks About

When “24/7 Support” Means Nothing

Every UCaaS vendor advertises 24/7 support. What they don’t advertise is offshore centers staffed with agents who follow scripts and escalate everything requiring judgment.

When client call quality degrades, offshore support runs through standard checklists. When that doesn’t work—because the problem requires configuration changes—tickets escalate to “engineering” and sit for days.

U.S.-based support costs more. That’s why most vendors eliminated it. MSPs pay the price fielding angry client calls because reseller support is useless.

The Real Test: Response Time Under Pressure

Support quality reveals itself during crises. When a client’s system fails, does support answer in 30 seconds or route through menus for 10 minutes? Can they diagnose and fix problems or just create tickets?

Ask potential resellers for actual average response times. Ask about escalation paths. Ask whether technicians have administrative access to fix problems immediately.

Most importantly, call current MSP partners. If the reseller refuses to provide references, that’s the answer.

Why Support Matters for MSP Margins

Bad reseller support destroys MSP profitability. Every hour spent troubleshooting issues the reseller should handle erodes margins. When MSPs become the de facto support team because reseller support is incompetent, the “30-40% margins” promised during sales become 10-15% after accounting for support labor.

Competent reseller support protects MSP margins by solving technical problems without MSP intervention. When clients call with issues, MSPs should confidently direct them to reseller support knowing problems will actually get solved—not deflected back to the MSP.

Call Attestation: The Crisis Your Clients Don’t See Coming

STIR/SHAKEN and Why It Matters

STIR/SHAKEN authentication determines whether business calls display properly or get flagged as “Spam Likely.” Enforcement is accelerating in 2026, and unprepared businesses will watch answer rates plummet.

Attestation levels matter. A-level (full verification) means carriers trust the call. B and C-level trigger spam flags. When client calls show “Spam Likely,” that’s failed attestation.

Resellers on proper carrier infrastructure achieve A-level automatically. Those using discount carriers often deliver B or C-level, then act surprised when calls get blocked.

The MSP’s Responsibility (Whether Fair or Not)

When a client’s outbound sales calls start showing “Spam Likely,” they don’t blame the carrier or the UCaaS platform. They blame the MSP who sold them the phone system. Fair or not, attestation problems become the MSP’s problem.

Proactive resellers handle attestation automatically: proper carrier relationships, correct number registration, A-level attestation verification before deployment. Reactive resellers wait for clients to complain, then spend weeks troubleshooting what should have been configured correctly initially.

Ask potential resellers direct questions about attestation:

- What attestation level do client calls receive?

- How is number registration handled?

- What happens when carriers flag calls incorrectly?

- Who manages ongoing attestation compliance?

If the reseller can’t answer these questions specifically, their clients’ calls are already at risk.

AI Features: Value vs. Revenue Extraction

The AI Add-On Trap

UCaaS vendors discovered AI creates pricing opportunities. Basic platforms cost $25 per seat. AI features add $15-20 more. For 50 seats, that’s $9,000-12,000 additional annual revenue for features costing pennies to operate.

Not all AI justifies premium pricing. Call summarization saves 3.2 hours weekly per employee—real ROI. AI-generated hold music? Expensive feature nobody needs.

Practical AI vs. Marketing AI

AI should solve problems or create value. Practical AI: call summarization eliminating manual notes, sentiment analysis for quality monitoring, intelligent routing reducing handle times 20-30%, speech analytics for compliance.

Marketing AI: expensive features that sound impressive but deliver minimal value. Some AI features cost more annually than hiring a full-time employee to handle the same tasks. A 50-seat deployment paying $15 per seat monthly for AI receptionist features costs $9,000 annually—that’s just for the software license, not the usage. With per-minute AI interaction charges added on top, total costs can easily exceed $50,000 per year. At that price, businesses could hire a full-time receptionist who actually understands the business, recognizes regular callers, and provides better customer experience than any AI system.

Other AI features complicate things that simple auto attendants or phone trees handle perfectly well. “AI-powered call routing” that costs $20 per seat monthly often does exactly what a properly configured IVR menu accomplishes for free. The AI doesn’t magically understand caller intent better than well-designed menu options—it just costs more and introduces unnecessary complexity that breaks when the AI misinterprets requests.

Ask resellers which AI features are included, which cost extra, and what ROI data exists. If they can’t explain ROI, they’re selling features, not value. Better yet, ask whether the AI feature solves a problem that simpler, cheaper solutions already handle effectively.

Infrastructure: Marketing vs. Reality

Private vs. Shared Platforms

Shared multitenant infrastructure means multiple clients share servers and capacity. When one client has problems, others suffer collateral damage.

Private instances dedicate infrastructure to individual clients. Problems stay isolated. Performance stays consistent.

Shared costs less. That’s why most resellers use it. MSPs lose clients whose systems failed at critical moments.

Reading SLAs vs. Marketing

Vendors market “99.999% uptime” (5 minutes downtime annually). SLAs guarantee 99.9% (8.76 hours annually). The difference between marketing and contracts reveals reality.

Read the actual SLA. What uptime is guaranteed? What remedies exist for failures? If the reseller won’t provide the SLA during evaluation, that’s the answer.

MSP UCaaS Reseller Comparison: What to Look For

| Feature | Bad Resellers | What MSPs Should Demand |

|---|---|---|

| Support | Offshore ticket systems, 10+ min hold times | U.S.-based technicians, <60 second response |

| Attestation | B/C-level, reactive problem solving | A-level automatic, proactive management |

| AI Pricing | $15-20/seat add-ons, usage fees | Practical AI included in base pricing |

| Infrastructure | Shared multitenant, 99.9% SLA | Private instance options, 99.999% verified |

| Installation | Ship-and-pray, generic setup guides | White-glove with dedicated project managers |

| MSP Support | “Figure it out yourself” model | Protects margins, solves problems proactively |

| Transparency | Hidden fees, vague commitments | Clear SLAs, honest pricing, no surprises |

White-Glove Installation: When Implementation Actually Matters

Why Most Deployments Fail

UCaaS implementations fail when resellers treat installation as commodity service. Ship equipment, provide login credentials, hand clients a setup guide, and hope for the best. Clients struggle with call flow configuration, CRM integration, and number porting complexities. Problems discovered post-launch require expensive fixes and erode client satisfaction from day one.

White-glove installation means dedicated project managers coordinate every detail: number porting timelines, equipment delivery, call flow testing, CRM integration, user training, and post-launch support. Problems get identified and fixed before go-live, not after clients start complaining.

MSPs should never accept responsibility for installation failures caused by reseller incompetence. When resellers provide inadequate installation support, MSPs either supplement with their own resources (destroying margins) or deliver poor client experiences (destroying retention).

The 14-Month ROI Standard

Industry data shows properly implemented UCaaS deployments reach ROI breakeven at 14 months. Poorly implemented deployments stretch to 24+ months because employees work around problems instead of using systems effectively.

The difference isn’t the technology—it’s the implementation. MSPs partnering with resellers who provide competent installation protect client ROI and their own reputations.

What MSPs Should Actually Demand

Stop accepting mediocrity as industry standard. Here’s what MSPs should demand from UCaaS resellers in 2026:

- Verifiable support quality – U.S.-based technicians with administrative access who answer in seconds and solve problems without deflecting to tickets. Get references from current MSP partners and actually call them.

- Proactive attestation management – A-level STIR/SHAKEN attestation verified before deployment, proper number registration handled automatically, branded calling included not upsold.

- Reasonable AI pricing – Practical AI features included in base tiers or offered at marginal cost, not premium pricing for basic functionality. ROI data for every AI feature charged separately.

- Private infrastructure options – Ability to deploy clients on dedicated instances when reliability matters more than cost savings. Contractual SLAs matching marketing claims.

- Competent installation – White-glove deployment with dedicated project managers, comprehensive testing before go-live, and post-launch support extending beyond “good luck.”

- Transparent pricing – No hidden fees, clear overage policies, straightforward contract terms without gotchas buried in fine print.

MSP UCaaS Reseller Evaluation Checklist

Use this checklist when evaluating potential UCaaS reseller partners:

- ☐ U.S.-based support with <60 second average response times

- ☐ A-level STIR/SHAKEN attestation automatically configured

- ☐ Practical AI features included in base pricing (not $15-20/seat add-ons)

- ☐ Private infrastructure deployment options available

- ☐ White-glove installation with dedicated project managers

- ☐ Transparent SLAs that match marketing claims (99.999% actual vs advertised)

- ☐ Current MSP partner references willing to discuss support quality

- ☐ Clear margin protection policies (no direct sales creating channel conflict)

- ☐ Documented escalation paths for critical issues

- ☐ Post-sale support that doesn’t deflect problems back to MSPs

Why This Matters for MSP Success

UCaaS should generate predictable recurring revenue with minimal operational burden. Bad reseller relationships turn UCaaS into constant firefighting that consumes MSP resources and threatens client retention.

Techmode operates exclusively through MSP and reseller partners—no direct sales creating channel conflict. Private AWS infrastructure delivers actual 99.999% uptime, not marketing fiction. U.S.-based concierge support answers in seconds with technicians who solve problems instead of creating tickets. STIR/SHAKEN attestation and branded calling are handled automatically, not sold as premium upgrades. AI features like call summarization are included, not nickeled-and-dimed through tier upgrades.

White-glove installation with dedicated project managers eliminates implementation chaos. An NPS of 85 versus industry average of 34 shows in client retention and MSP partner satisfaction. With an A+ BBB rating and 20+ years of experience, Techmode backs up partner commitments with actual performance—not just sales promises.

MSPs deserve resellers who protect their margins, solve technical problems proactively, and deliver client experiences that drive retention. Settling for less means competing on price instead of value. In 2026, that’s a race to the bottom nobody wins.

Frequently Asked Questions

Q: How can MSPs verify a reseller’s support quality before committing?

A: Request contact information for 3-5 current MSP partners and actually call them. Ask specific questions: average response times, escalation experiences, problem resolution rates, whether they’d choose the reseller again. If the reseller refuses to provide references or only offers cherry-picked testimonials, that reveals support quality. Also test support directly during evaluation—submit a technical question and measure response time and solution quality.

Q: What’s the difference between A-level and B-level STIR/SHAKEN attestation?

A: A-level attestation means the carrier fully verifies the caller’s identity and phone number ownership. B-level means partial verification—the carrier verifies the call path but not the caller identity. C-level is gateway only with no verification. Many carriers flag B and C-level calls as potential spam. Only A-level attestation reliably prevents “Spam Likely” labels. MSPs should demand verification that client calls receive A-level attestation.

Q: Are AI features worth the premium pricing most UCaaS vendors charge?

A: Some AI features deliver measurable ROI—call summarization saving 3+ hours weekly per employee, sentiment analysis improving quality monitoring, intelligent routing reducing handle times. These justify reasonable pricing. Other AI features are revenue extraction disguised as innovation. Evaluate each AI feature on actual business value: time saved, efficiency gained, problems solved. If the reseller can’t quantify ROI, the feature isn’t worth premium pricing.

Q: How important is private instance infrastructure vs. shared platforms?

A: For clients where reliability determines revenue—call centers, sales teams, healthcare providers—private instances matter significantly. Shared infrastructure saves costs but risks collateral damage when neighboring clients experience problems. For price-sensitive clients with less critical use cases, shared infrastructure is adequate. MSPs should have access to both options and choose based on client requirements, not just reseller limitations.

Q: What’s realistic for UCaaS margins in 2026?

A: Wholesale/reseller models deliver 30-40% margins when executed properly with minimal support burden. These margins require competent reseller support handling technical issues without MSP intervention. MSPs providing extensive support because reseller support fails see margins drop to 10-15%. Agency/referral models offer 10-20% commissions with zero support burden. The model matters less than ensuring the reseller doesn’t destroy margins through incompetence requiring MSP supplemental support.