What This Article Covers

UCaaS and CCaaS providers routinely present quotes that exclude legally required taxes and government fees — sometimes intentionally, sometimes through creative accounting. This practice can leave businesses shocked by their first invoice, and in some cases, legally exposed for unpaid tax obligations they didn’t even know existed. This post breaks down the difference between taxes (government-mandated) and fees (discretionary provider charges), explains the legal risks of carriers who skip 911 and telecom tax collection, and shows what businesses should demand in writing before signing any communications contract.

There’s a time-honored tradition in the UCaaS and CCaaS sales world:

Show the prospect the lowest possible number, get the signature, and let the billing department handle the awkward explanations later. It’s the telecom equivalent of buying a car for the sticker price, then discovering the dealer forgot to mention taxes, registration, documentation fees, and the mysterious “lot preparation charge.”

Businesses comparing phone system quotes often focus on the per-seat price. That’s understandable — it’s the number sales reps lead with, the number that gets repeated in budget meetings, and the number that gets approved. What doesn’t always make it into the presentation? The taxes and fees that are, by law, going to show up on the invoice one way or another. Understanding how per-seat UCaaS pricing actually works — and what it should include — is the first step to not getting ambushed by the first bill.

This isn’t a conspiracy theory. It’s a business model — and understanding it could save companies from some very unpleasant surprises, including ones that come with government penalties attached.

Not All Quotes Are Built the Same

When businesses receive a UCaaS or CCaaS quote, they’re typically looking at a per-seat or per-line rate. What they’re often not looking at is a full accounting of what that rate excludes. And in the telecom world, what gets excluded can be substantial.

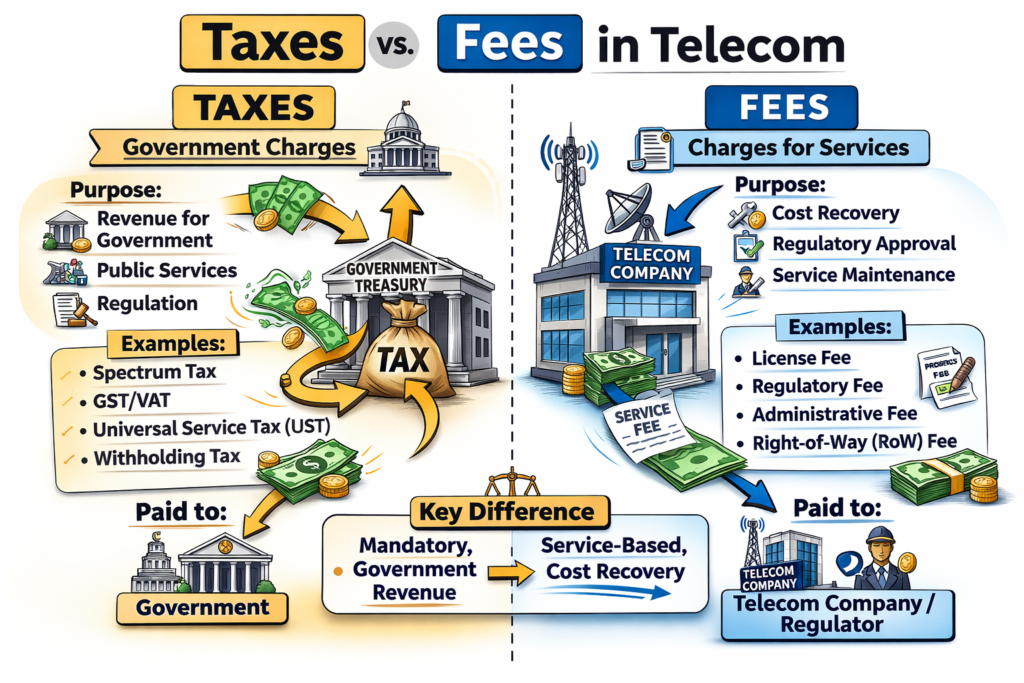

There are two fundamentally different categories of charges that appear on a telecom bill, and conflating them — intentionally or not — is where the trouble starts.

Fees are discretionary charges assessed by the provider itself. They go by a lot of names: Regulatory Cost Recovery Fee, Federal Cost Recovery Charge, Recovery Fee Charge, Public Utility Compliance Surcharge. These are not government charges.

They are the carrier’s way of recovering their own operational costs — things like FCC compliance expenses, carrier interconnection charges, infrastructure regulatory filings, and administrative overhead. Providers set these themselves, which means they vary significantly between carriers and can change without much notice.

Taxes are a different animal entirely. Federal Universal Service Fund contributions, State Excise Taxes, Public Utility Excise Taxes, State Sales and Use Taxes, State 9-1-1 charges, City 911 Surcharges, County 9-1-1 Fees, and the Statewide 9-8-8 Surcharge — these are mandated by federal, state, county, and city governments. They’re not optional. They’re not negotiable. And they should be fairly consistent between providers operating in the same jurisdiction.

Fees vs. Taxes — What’s Actually on Your Telecom Bill

| FEES (Provider-Set) | TAXES (Government-Mandated) | |

|---|---|---|

| Who sets them? | The provider | Federal, state, county, or city government |

| Required by law? | No — discretionary | Yes — legally mandated |

| Vary between providers? | Yes — significantly | Minimally — consistent by jurisdiction |

| Provider can change them? | Yes — often with little notice | No — set by legislation |

| What do they fund? | Provider’s operational & compliance costs | Public infrastructure, emergency services |

| Legal liability if unpaid? | No | Yes — business can be held liable |

Common Tax Categories You’ll See

| Tax Category | Examples |

|---|---|

| Federal Taxes | Federal Universal Service Fund (FUSF), Federal Universal Service Fee, Federal Cost Recovery Fee/Charge |

| State-Level Taxes | State Excise Tax, Public Utility Excise Tax, State Sales Tax, State Use Tax |

| 911 & 988 Public Safety Taxes | State 9-1-1 Charge, City 911 Surcharge, County 9-1-1 Fee, Statewide 9-8-8 Surcharge |

What Public Safety Taxes Fund: Emergency response infrastructure · Public safety answering points · National suicide prevention hotline (988) · Relay services for accessibility · Infrastructure in underserved areas

The chart above isn’t theoretical. These are the actual line items that appear on telecom bills — and the ones that conveniently disappear from some initial quotes.

The “Low Quote” That Comes With a Catch

Here’s how the game is played. A business reaches out to a UCaaS or CCaaS provider. The rep comes back with a per-seat price that looks competitive — maybe even suspiciously good. The quote document is clean and simple.

The total looks manageable.

Then the service goes live. The first bill arrives.

Suddenly there are line items that weren’t in the proposal. Some are labeled as fees — those discretionary provider charges discussed above.

Others are labeled as taxes. Combined, they can add anywhere from 15% to 30% or more to the base price, depending on the state, city, and service type.

At this point, the business has two options: dispute it (good luck, they signed a contract) or pay it and adjust the budget accordingly. Neither option is particularly satisfying.

Some providers are upfront about this. Their quotes say “plus applicable taxes and fees” in fine print that most people skip over.

Others simply don’t include taxes at all — not as a line item, not as an estimate, not even as a footnote. And a small subset are doing something that goes well beyond inconvenient: they’re not collecting legally required taxes at all.

Why Do Providers Do This? (Spoiler: It’s Not an Accident)

It would be charitable to assume that every low quote is an honest mistake — a well-meaning sales rep who didn’t model out the full tax picture. And occasionally, that’s actually true.

In many cases, the omission isn’t just deliberate. It’s the business model.

Here’s the part of the sales playbook that doesn’t make it into the pitch deck: provider fees aren’t just a cost-recovery mechanism.

They’re a profit recovery mechanism.

When a UCaaS or CCaaS provider discounts their per-seat price to win a deal — and they will discount aggressively to win a deal — that margin doesn’t just evaporate. It gets rebuilt on the back end through fees that weren’t in the proposal.

The Regulatory Cost Recovery Fee. The Federal Cost Recovery Charge. The Public Utility Compliance Surcharge.

These labels sound like taxes, but they aren’t. They’re discretionary charges that the provider sets and adjusts at will. And when a carrier needs to make up margin they gave away during negotiations, fees are exactly how they do it. The customer sees a line item that sounds governmental and official. They assume it’s unavoidable. They pay it.

It’s not by chance. It’s by design. Providers count on those fees.

A quote that looks $8 per seat cheaper than the competition might be deliberately undercut — with full knowledge that the fee stack will close the gap after the ink is dry.

The sales rep gets credit for winning a competitive deal. Finance gets their margin back on the invoice. The customer gets an education about how telecom billing actually works, approximately 30 days into their 36-month contract.

This is also why the fee side of a telecom bill varies so dramatically between providers, while the tax side stays relatively consistent. Taxes are set by governments. Fees are set by people who have a revenue target to hit.

A quote that breaks out fees honestly — real dollar amounts, not vague references to “applicable charges” — is a quote from a provider that isn’t planning to recover their discount later.

That’s the version businesses should be demanding before they sign anything. For MSPs evaluating UCaaS partners on behalf of clients, transparent pricing is one of the non-negotiables worth walking away over.

When Missing Taxes Become a Legal Problem

This is where the conversation shifts from “frustrating billing surprise” to “call your accountant immediately.”

In most states, 911 and telecom taxes are legally imposed on the end user — the business subscribing to the service — even though the carrier is responsible for collecting and remitting them.

This is a critical distinction that most businesses don’t learn about until it’s too late.

If a carrier presents a quote that doesn’t include these taxes, businesses might assume they’re getting a better deal.

What they may actually be getting is a ticking legal exposure. The absence of tax collection by the carrier doesn’t eliminate the underlying tax obligation. It just means nobody has paid it yet.

As the subscriber, a business can still be held liable for unpaid telecom taxes if the discrepancy is ever discovered during an audit. And “discovered during an audit” is exactly the kind of phrase that ruins a CFO’s afternoon.

The exposure isn’t just the original tax amount — it’s the original amount, plus potential penalties, plus interest, potentially going back years.

The 911 compliance angle adds another layer of risk that’s easy to overlook.

Under Kari’s Law and RAY BAUM’s Act, businesses operating multi-line telephone systems are required by federal law to provide direct 911 access and transmit accurate dispatchable location data with every emergency call.

Improper 911 registration or failure to collect and remit E911 taxes can create regulatory liability and real-world consequences if emergency services are ever needed and location data isn’t properly registered or maintained. The FCC is empowered to impose fines and penalties for non-compliance.

That’s not a billing problem. That’s a safety and legal problem.

Before signing any telecom contract — and certainly before assuming that a low quote means no taxes — businesses should require written confirmation that the carrier:

- Is properly registered in the state where service is being provided

- Is actively collecting and remitting all required local and E911 taxes

- Is fully compliant with E911 regulations for every location being served

Lower upfront costs can mask long-term financial and legal exposure.

A quote that looks $10 per seat cheaper might carry thousands of dollars in tax liability that nobody’s collecting — yet.

What a Transparent Quote Actually Looks Like

A legitimately transparent UCaaS or CCaaS quote breaks out the following:

The base per-seat or per-line rate. Provider fees with actual dollar amounts — not vague references to “applicable fees.”

An estimated tax total based on the business’s state and city — not a promise that taxes are “included” without documentation of what that means. Any one-time implementation or setup charges. And a clear explanation of what can change, and when.

Businesses should ask for a sample invoice from an existing customer in the same state before signing.

A provider that balks at that request is telling businesses something important about what they can expect once the contract is countersigned and the porting order is submitted.

The hidden costs of UCaaS go well beyond taxes and fees — but those are the ones that tend to show up first, and loudest.

TechmodeGO Doesn’t Play That Game

After reading through all of this, businesses might reasonably wonder whether there’s a provider that actually tells them the full number upfront and means it.

TechmodeGO approaches billing the way a business would actually want: with clarity, consistency, and no surprises engineered into the contract.

Quotes from Techmode include the real picture — not a per-seat number designed to win the comparison before the fee stack does the dirty work somewhere around invoice number two.

The Techmode difference starts before the sale and extends well past it.

Every TechmodeGO deployment comes with a dedicated project manager and an experienced install team through the Premier Launch process — white-glove installation that covers everything from number porting to call flow testing before go-live. Businesses don’t discover what’s broken after the system is live. That’s someone else’s approach.

After installation, Techmode’s Concierge Services provide U.S.-based support from technicians who actually know the client’s system. No offshore call centers. No ticket queues that go quiet for 72 hours.

Real people who pick up, know the account, and solve problems. That’s why Techmode maintains an NPS of 85 — which, in an industry full of providers customers tolerate rather than recommend, is not a small distinction.

On the compliance front, Techmode handles STIR/SHAKEN authentication and E911 routing through its infrastructure — with emergency location compliance handled properly from day one. Private, triple-redundant AWS infrastructure delivers 99.999% uptime that isn’t shared with other tenants who might have a bad day.

Businesses that are tired of discovering what their phone bill actually costs after they’ve signed? That’s a conversation worth having. Schedule a free consultation with Techmode to see what a complete, transparent quote looks like.

Frequently Asked Questions

Q: What’s the difference between a fee and a tax on a telecom bill?

Taxes are government-mandated charges — federal, state, county, and city — that fund things like E911 infrastructure, the 988 suicide prevention hotline, and public safety answering points. Fees are discretionary charges set by the provider itself to recover their own operational costs, like FCC compliance expenses and carrier interconnection charges. They’re both real line items, but only taxes are legally required — and only taxes carry legal liability if they’re not collected and remitted properly.

Q: If a carrier doesn’t charge for 911 taxes, does that mean a business doesn’t owe them?

Unfortunately, no. In most states, 911 and telecom taxes are legally imposed on the subscriber — the business — even though the carrier is responsible for collecting and remitting them. If the carrier isn’t collecting those taxes, the obligation doesn’t disappear. The business can still be held liable for unpaid amounts if an audit ever surfaces the gap, along with potential penalties and interest.

Q: What should businesses ask for before signing a UCaaS or CCaaS contract?

At minimum, businesses should request written confirmation that the carrier is properly registered in their state, is collecting and remitting all required local and E911 taxes, and is fully E911 compliant for every location. A sample invoice from an existing customer in the same state is also a reasonable and revealing request. If a provider resists providing that documentation, that resistance is itself an answer.

Q: How much do taxes and fees typically add to a base UCaaS quote?

The total varies by state, city, and service type, but it’s common for combined taxes and fees to add 15% to 30% or more to a base per-seat rate. A quote that looks like $25 per seat can realistically land at $30–$35 per seat once all government-mandated taxes and provider fees are included. The variation between providers on the fee side — as opposed to the tax side — is where a lot of the creative pricing lives.

Q: How can businesses tell if a quote is genuinely all-inclusive or just hiding costs?

Look for a line-by-line breakdown that separates base rates, provider fees, and tax estimates. A quote that lists “plus applicable taxes and fees” without providing dollar estimates is leaving money undefined on purpose. Ask for the full breakdown and request a sample bill — a provider confident in their billing practices won’t hesitate to show it.

Disclaimer: Tax obligations vary by jurisdiction and service type. Businesses should consult with a qualified tax or legal advisor regarding their specific compliance obligations before entering into any telecommunications service agreement.